Frequently Asked Questions

What is $FLUUS?

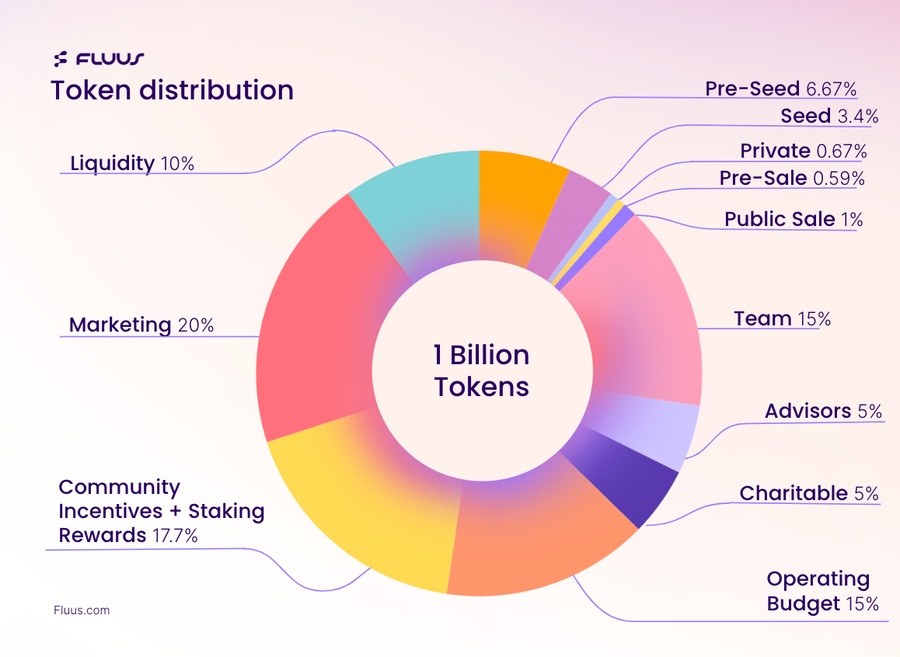

$FLUUS utility token is a pre-minted, fixed supply token. There will only ever be 1 billion $FLUUS tokens minted and in circulation. $FLUUS will be an Avalanche token with the following allocations.

Where is $FLUUS listed?

$FLUUS is listed on MEXC Exchange. https://www.mexc.com/price/FLUUS

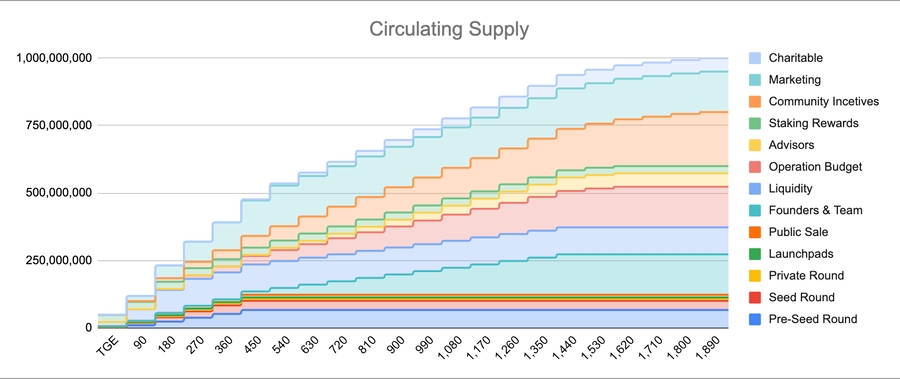

What is the $FLUUS circulation structure?

The tokens are being introduced into circulation in stages. The volume of FLUUS tokens in circulation will gradually increase to meet the demand generated by the following:

The lock-up of FLUUS tokens as collateral for on and off-ramp partners.

The staking of FLUUS tokens by users to earn rewards.

The staking of FLUUS tokens by businesses to receive fee reductions and unlock features.

The holding of FLUUS tokens by community members.

The use of FLUUS as a governance token.

Early participants, founders, and contributors will receive their tokens subject to vesting and lockup schedules.

How is the FLUUS aggregator different from other aggregators?

FLUUSPay is included in our aggregator and it covers emerging markets, while existing ones do not.

The FLUUS Pay network offers payment methods like cash and mobile money.

FLUUS has a smart selection engine to give the best fees to our users.

It is collateralized, so user funds are always protected.

FLUUS continuously sources the best rates, so always able to compete on prices.

Where is FLUUS Desk operational?

FLUUS Desk is operational in Lebanon, Jordan, Palestine, Ukraine, Dubai, and very soon Algeria.

Are there any integration fees for the FLUUS Aggregator?

No, integrations are free. FLUUS utilizes a revenue-sharing model with partners based on transaction fees.

Is there a proper risk management structure for the collateral?

Yes, FLUUS partners with on/off-ramp services to provide coverage in emerging markets. FLUUS utilized a collateralized system where on/off ramp partners are required to set FLUUS tokens as collateral. This is done to protect users against unforeseen circumstances, disrupted services or fraud.

Collateral is locked per specific transaction and unlocked after a successful transaction. Partners lock a conservative amount of FLUUS tokens as collateral for the duration of their transaction (e.g. lock 3X the value of the transaction in FLUUS tokens for 3 hours).

Since a conservative amount of collateral is locked for a shorter period of time, the collateralization ratio will remain maintained as it is unlikely for the token price to drop below the set threshold.

In the case the ratio is disturbed, FLUUS can loan partners tokens to top up their collateral amount and maintain their transaction volumes.

If the price of the FLUUS token goes up, clients can sell surplus once the time period is done or they use it to increase their txn amounts. (If they own it, if it’s a loan it gets returned back to FLUUS)

A slashing mechanism is also implemented. Each potential risk and dispute is quantified and covered by the slashing of the bad actors' collateral. This acts as a service guarantee for the customers.

How can users receive rewards?

Retail users can receive rewards by the following actions:

Providing liquidity in the FLUUS liquidity pool

Performing actions beneficial to the FLUUS ecosystem. FLUUS utilizes bounties in order to reward community members for their contributions.

Staking FLUUS in the FLUUS staking pools. The reward is proportional to volume and time staked.

How is FLUUS unique?

FLUUS offers unique solutions that are non-existent in the market. Such as:

FLUUS Pay payment methods that are designed for emerging markets to help with global adoption.

Our unique implementation of FLUUS Pay where we partner with Fintech operators, money transfer networks and mobile money operators to offer crypto ramping services that are regulated, compliant and offer settlements under a payments licensing structure.

An Aggregation Layer where developers benefit from a single integration and a smart selection engine that provides global coverage at a lower cost and faster time to market.

Last updated